Common Mistakes to Avoid in Rental Income Accounting

Common Mistakes to Avoid in Rental Income Accounting

Blog Article

Income base sales is just a easy and sensible approach that many rental home homeowners use to handle their finances. It's specially popular among small-scale landlords due to its simplicity. Unlike accrual accounting, this method records revenue and expenses only when they're really obtained or compensated, which makes it easier to accounting for rental properties.

If you are managing rental properties, knowledge cash schedule accounting can assist you to simplify your bookkeeping process while remaining certified with duty regulations. Here's how you should use this process effectively.

What Is Money Base Accounting?

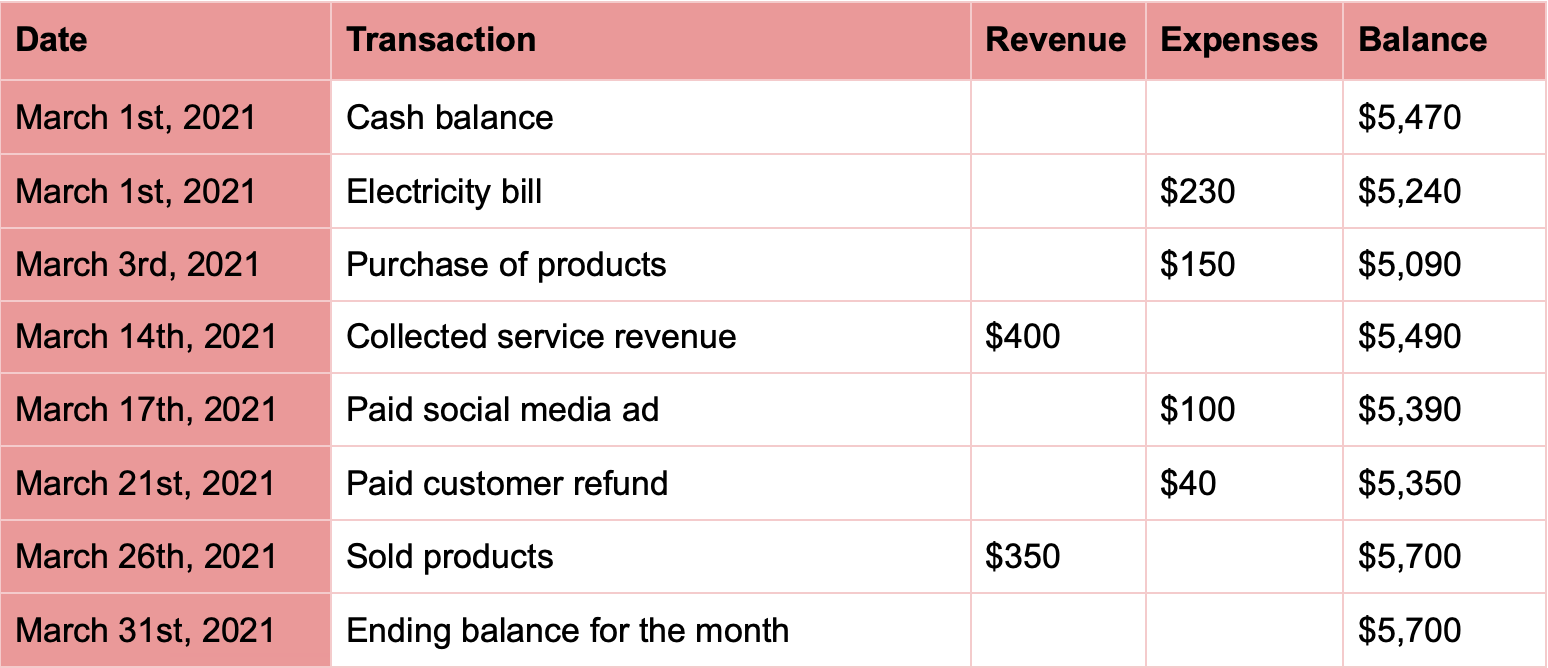

Income base accounting is an sales method wherever you history revenue when you get the book payment and report expenses when you actually pay them. It centers on the quick motion of cash in and out of your accounts.

As an example, if your tenant pays their rent on January fifth for book owed in December, you report that payment in January when the cash was literally acquired (not in December when the lease was due). Similarly, expenses like home repairs or insurance premiums are signed when the cost is created, not once the invoice is issued.

Great things about Money Foundation Sales for Rental Properties

1.Simplicity: Income basis accounting is extremely easy to set up and maintain. It takes small bookkeeping understanding, rendering it accessible for hire home owners only starting.

2.Clear Cash Movement Overview: This approach gives a clear photograph of how much cash is arriving and going out at any given time, that is critical for managing a hire property.

3.Tax Time Advantages: Since money and expenses are recorded when they are received or compensated, you may have some freedom in time deductions or revenue recognition to reduce your tax responsibility strategically.

Measures to Apply Cash Basis Sales

Track Revenue

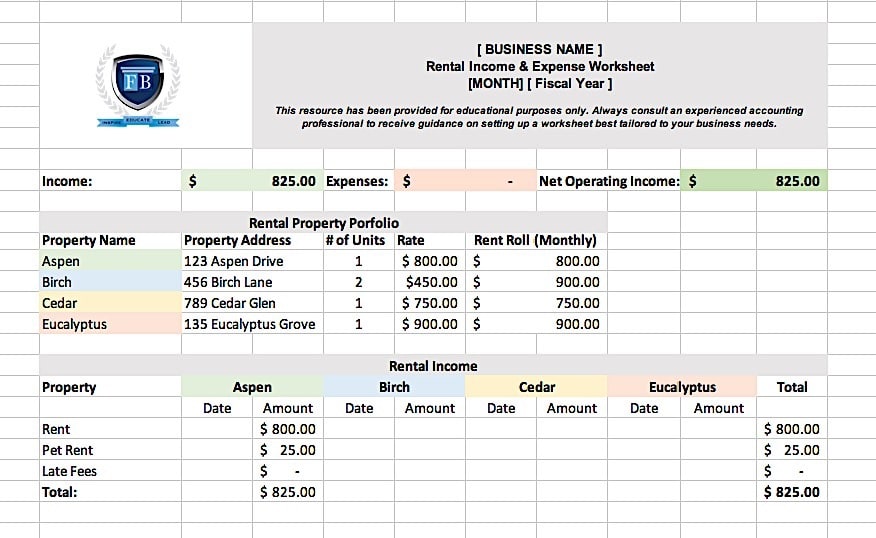

Report book funds the moment they're placed in to your bank account. Make sure to note the cost day, amount, and tenant name for correct tracking. Computer software like copyright or perhaps a easy spreadsheet can make this technique significantly easier.

History Expenses

If you make obligations for property-related expenses like utilities, fixes, or loan passions, make a record of these proper away. Keep receipts and invoices as proof for future reference or tax purposes.

Arrange Papers

Set up versions for bodily or electronic records to keep money and cost paperwork organized. Proper company can help you simplify your duty filing process.

Monitor Frequently

Regularly monitor your money movement and make fully sure your documents are up-to-date. This may also support you want and spend funds for constant maintenance or sudden expenses.

Cash schedule sales for hire homes can offer much-needed simplicity and quality, especially for landlords controlling just a few units. Employing this process, you can easily monitor your cash flow while outstanding tax-compliant and reducing the difficulties of bookkeeping. Report this page